For independent contractors, contractor financing offers flexibility and stability in an uncertain job market, aiding cash flow management, equipment acquisition, and project uptake without traditional bank loans. Popular options include short-term loans and lines of credit from banks, credit unions, or online lenders, with careful comparison of lender criteria essential. A thorough application process involves gathering documents, showcasing professional credentials, and transparently discussing unique work aspects. Effective repayment strategies, like structured budgeting and debt management methods, ensure financial health while managing contractor financing.

In today’s economy, independent contractors face unique financial challenges. Contractor financing plays a pivotal role in empowering freelancers to secure projects and manage cash flow. This comprehensive guide explores why contractor financing is essential for freelancers, delving into various loan options available, from traditional banks to alternative lenders. We navigate the application process step-by-step and offer strategies for successful debt management, ensuring self-employed individuals can thrive financially.

- Understanding Contractor Financing: Why It's Crucial for Freelancers

- Exploring Loan Options: Types and Lenders for Independent Contractors

- Navigating the Application Process: What to Expect and How to Prepare

- Managing Repayment: Strategies for Successful Debt Management as a Self-Employed Individual

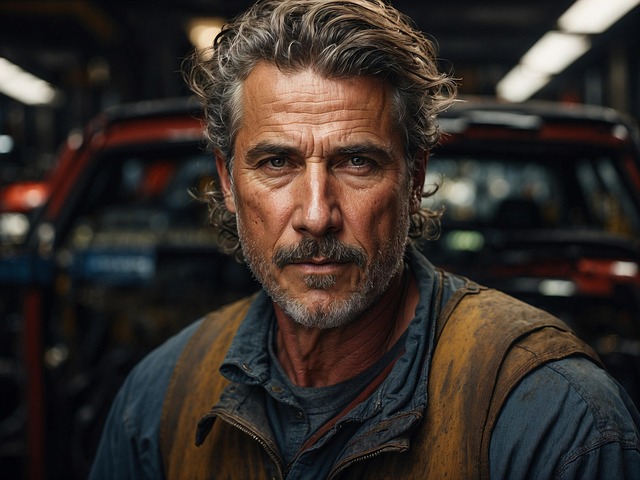

Understanding Contractor Financing: Why It's Crucial for Freelancers

For independent contractors, understanding contractor financing is not just beneficial; it’s essential for navigating the financial landscape of their freelancing careers. In a world where traditional employment isn’t always stable or accessible, having alternative funding options becomes paramount. Contractor financing offers these freelancers the flexibility and security to manage cash flow, invest in equipment, and take on projects that might be lucrative but require upfront costs.

This type of financing specifically caters to the unique needs of contractors by providing loans designed for self-employed individuals. It allows them to access capital without the stringent requirements often attached to traditional bank loans, such as a fixed employment status or extensive credit history. With contractor financing, freelancers can focus on what they do best—delivering quality work and growing their businesses—while ensuring financial stability along the way.

Exploring Loan Options: Types and Lenders for Independent Contractors

Independent contractors often find themselves in a unique financial position, as traditional loan options may be limited. Exploring contractor financing is, therefore, a crucial step for those seeking to expand their business or cover short-term cash flow needs. The good news is that there are various loan types tailored specifically to this demographic.

One popular option is the short-term loan, which is typically unsecured and offers faster approval times compared to conventional loans. These loans are ideal for immediate funding requirements. Another type worth considering is the line of credit, providing contractors with access to funds on an as-needed basis. This flexibility allows them to borrow only when necessary and pay interest on the outstanding balance. When it comes to lenders, there are multiple options available, including banks, credit unions, and specialized online lenders who cater specifically to contractor financing needs. Each lender has its own criteria for eligibility, so contractors should research and compare rates, terms, and conditions to find the best fit for their financial situation.

Navigating the Application Process: What to Expect and How to Prepare

Navigating the application process for contractor financing can seem daunting, but with the right preparation, it can be a smooth and successful experience. Independent contractors should start by gathering all necessary documents, including tax returns, financial statements, and identification. These documents are crucial for lenders to assess your financial health and eligibility for a loan.

Next, contractors should expect a thorough review of their application. Lenders will examine your credit history, business structure, and project details. It’s important to present yourself professionally, provide accurate information, and be prepared to answer questions about your work as an independent contractor. This may include explaining unique aspects of your business or industry. By being organized and honest throughout the process, contractors can increase their chances of securing the necessary contractor financing for their projects.

Managing Repayment: Strategies for Successful Debt Management as a Self-Employed Individual

As an independent contractor, managing repayment for contractor financing can seem daunting, but there are strategies to ensure successful debt management. One key approach is to create a detailed budget that allocates specific funds for loan repayments alongside other essential expenses and savings goals. This disciplined financial planning allows you to treat your loan payments as non-negotiable bills, similar to rent or utilities.

Additionally, consider prioritizing higher-interest loans first while making minimum payments on others. This strategy, known as debt avalanche, can help you reduce the overall interest paid over time. Another effective method is the snowball method, where you focus on paying off smaller debts swiftly before tackling larger ones. Either way, staying disciplined and consistent with repayments is crucial for maintaining good financial health as a self-employed individual.

For independent contractors, accessing appropriate funding is not just an advantage but a necessity. By understanding contractor financing and navigating the available loan options, freelancers can unlock opportunities for growth and stability. The application process may seem daunting, but with careful preparation, it becomes manageable. Moreover, adopting effective repayment strategies ensures that borrowing empowers rather than burdens self-employed individuals. Contractor financing is a tool that, when utilized wisely, can propel your freelance career to new heights.